Kentucky Vehicle Sales Tax Form . a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. In addition to taxes, car purchases in kentucky may be. kentucky collects a 6% state sales tax rate on the purchase of all vehicles. The state of kentucky has a flat sales tax of 6% on car sales. how much is the car sales tax in kentucky? motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be.

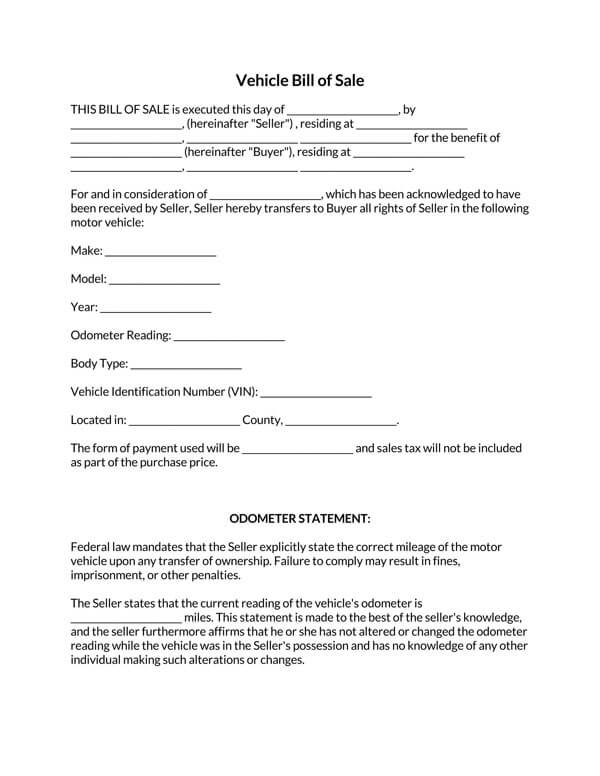

from www.wordtemplatesonline.net

for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. The state of kentucky has a flat sales tax of 6% on car sales. a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. In addition to taxes, car purchases in kentucky may be. kentucky collects a 6% state sales tax rate on the purchase of all vehicles. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. how much is the car sales tax in kentucky? download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from.

Kentucky Bill of Sale Form for Vehicle How to Register

Kentucky Vehicle Sales Tax Form for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. In addition to taxes, car purchases in kentucky may be. The state of kentucky has a flat sales tax of 6% on car sales. how much is the car sales tax in kentucky? kentucky collects a 6% state sales tax rate on the purchase of all vehicles.

From bill-of-sale-form-ky.pdffiller.com

Kentucky Motor Vehicle Bill Of Sale Fill Online, Printable, Fillable Kentucky Vehicle Sales Tax Form motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. The state of kentucky has a flat sales tax of 6% on car sales. how much is the car sales tax in kentucky? for consistency and uniformity, the department has provided guidance to. Kentucky Vehicle Sales Tax Form.

From pdfsimpli.com

kentucky motor vehicle bill of sale template PDFSimpli Kentucky Vehicle Sales Tax Form a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. for consistency and uniformity, the department has provided guidance to. Kentucky Vehicle Sales Tax Form.

From webinarcare.com

How to Get Kentucky Sales Tax Permit A Comprehensive Guide Kentucky Vehicle Sales Tax Form kentucky collects a 6% state sales tax rate on the purchase of all vehicles. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. The state of kentucky has a flat sales tax of 6% on car sales. a motor vehicle usage tax of. Kentucky Vehicle Sales Tax Form.

From formzoid.com

Free Fillable Kentucky Bill of Sale Form ⇒ PDF Templates Kentucky Vehicle Sales Tax Form In addition to taxes, car purchases in kentucky may be. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. . Kentucky Vehicle Sales Tax Form.

From formspal.com

Free Kentucky Bill of Sale Forms (PDF) FormsPal Kentucky Vehicle Sales Tax Form a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. kentucky collects a 6% state sales tax rate on the purchase of. Kentucky Vehicle Sales Tax Form.

From www.signnow.com

Printable Generic Bill of Sale Form Fill Out and Sign Printable PDF Kentucky Vehicle Sales Tax Form In addition to taxes, car purchases in kentucky may be. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. . Kentucky Vehicle Sales Tax Form.

From exceltmp.com

Free Kentucky Vehicle Bill of Sale Form (Word) Excel TMP Kentucky Vehicle Sales Tax Form for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. In addition to taxes, car purchases in kentucky may be. how much is the car sales tax in kentucky? motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the. Kentucky Vehicle Sales Tax Form.

From www.templateroller.com

Kentucky Motor Vehicle Bill of Sale Form Fill Out, Sign Online and Kentucky Vehicle Sales Tax Form In addition to taxes, car purchases in kentucky may be. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. kentucky collects a 6% state sales tax rate on the purchase of all vehicles. for consistency and uniformity, the department has provided guidance to. Kentucky Vehicle Sales Tax Form.

From www.formsbank.com

Fillable Form 51a135 Kentucky Sales Tax Motor Vehicle Sales Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from. how much is the car sales tax in kentucky? kentucky collects a 6% state sales tax rate on the purchase. Kentucky Vehicle Sales Tax Form.

From www.formsbank.com

Fillable Form 10a100 Kentucky Tax Registration Application For Kentucky Vehicle Sales Tax Form how much is the car sales tax in kentucky? kentucky collects a 6% state sales tax rate on the purchase of all vehicles. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. The state of kentucky has a flat sales tax of. Kentucky Vehicle Sales Tax Form.

From printablebillofsale.org

Free Kentucky Generic Bill of Sale Form Download PDF Word Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. In addition to taxes, car purchases in kentucky may be. how much is the car sales tax in kentucky? a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. . Kentucky Vehicle Sales Tax Form.

From www.templateroller.com

Form 51A270 Download Printable PDF or Fill Online Certificate of Sales Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall. Kentucky Vehicle Sales Tax Form.

From www.wordtemplatesonline.net

Kentucky Bill of Sale Form for Vehicle How to Register Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and. Kentucky Vehicle Sales Tax Form.

From billofsale.net

Free Kentucky DMV (Vehicle) Bill of Sale Form PDF Word (.doc) Kentucky Vehicle Sales Tax Form a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. motor vehicle usage tax is a tax on the privilege of using a motor vehicle upon the public highways of kentucky and shall be. download or print the 2023 kentucky form 51a270 (certificate. Kentucky Vehicle Sales Tax Form.

From forms.legal

Bill of Sale Form Kentucky for Motor Vehicle & General Sale Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. download or print the 2023 kentucky form 51a270 (certificate of sales tax paid on the purchase of a motor vehicle) for free from.. Kentucky Vehicle Sales Tax Form.

From esign.com

Free Kentucky Motor Vehicle Bill of Sale Form PDF Word Kentucky Vehicle Sales Tax Form In addition to taxes, car purchases in kentucky may be. how much is the car sales tax in kentucky? for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. kentucky collects a 6% state sales tax rate on the purchase of all vehicles. download or. Kentucky Vehicle Sales Tax Form.

From templatesowl.com

Free Kentucky Car Bill of Sale Template Fillable Forms Kentucky Vehicle Sales Tax Form The state of kentucky has a flat sales tax of 6% on car sales. kentucky collects a 6% state sales tax rate on the purchase of all vehicles. for consistency and uniformity, the department has provided guidance to retailers and county clerks to shift taxation from sales and use. a motor vehicle usage tax of six percent. Kentucky Vehicle Sales Tax Form.

From ceeepblp.blob.core.windows.net

Apply For Kentucky Sales And Use Tax Number at Sara Mohr blog Kentucky Vehicle Sales Tax Form In addition to taxes, car purchases in kentucky may be. how much is the car sales tax in kentucky? a motor vehicle usage tax of six percent (6%) is levied upon the “retail price” of vehicles registered for the first time in kentucky. for consistency and uniformity, the department has provided guidance to retailers and county clerks. Kentucky Vehicle Sales Tax Form.